Contents contributed and discussions participated by Skye Schmeitz

Koyal Group Training Services: 4-year Auto theft Investigation - 4 views

-

4-year auto theft, insurance scam investigation leads to arrests

4-year auto theft, insurance scam investigation leads to arrests

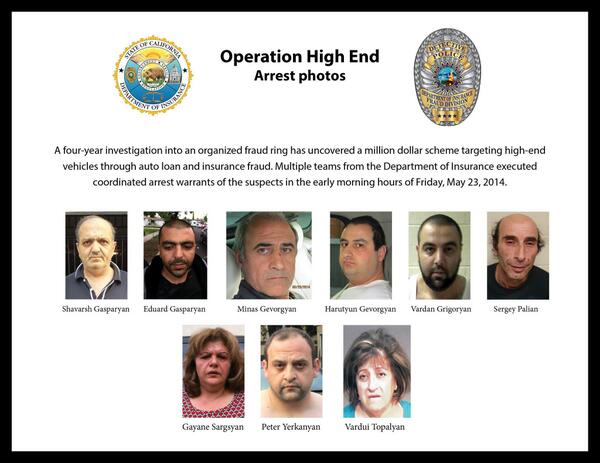

A four-year investigation ended Friday with 12 arrests, and more expected, in connection with a million-dollar auto theft ring that allegedly ripped off car dealerships and insurance companies in the Los Angeles area.

The California Department of Insurance said charges have been brought against 17 people in Los Angeles and one in Fresno.

The ring, according to the state agency, used phony credit cards and bogus bank accounts to purchase 21 high-end vehicles -- including cars made by Mercedes, Audi, BMW and Lexus -- from 18 different Los Angeles dealerships.

They insured the vehicles and crashed them, the Department of Insurance said, in staged wrecks that often involved multiple vehicles driven by members of the ring. They then made insurance claims on the damage and defaulted on the loans. Three of the cars were exported out of the country.

Twelve of the alleged car crooks are in custody following early morning arrests. Two are making arrangements to surrender and four are still being sought, a spokesperson for the state agency said. Among those arrested is a husband-and-wife team, the agency said.

Members of the alleged ring are being charged by the Los Angeles County district attorney's office with theft of a vehicle by false pretenses, insurance fraud, grand theft from insurance companies, perjury on Department of Motor Vehicle documents and giving false information on government documents.

"Insurance fraud is a multibillion-dollar drain on the California economy that results in higher insurance premiums for California businesses and consumers," said state Insurance Commissioner Dave Jones. "This organized ring filled their pockets by ripping off insurance companies and auto dealers."

The multi-agency investigation, dubbed Operation High End, originated in the Fresno office of the Department of Insurance, and went on to include assistance from the agency's offices in Valencia, Los Angeles, the Inland Empire, San Diego and Orange County.

The arrest sweep involved more than 100 officers, the agency said, at locations in Van Nuys, Glendale, North Hollywood, Los Angeles, Sunland, Granada Hills, Panorama City and Fresno.

Agencies participating in the arrests included the Los Angeles Police Department's Task Force for Regional Auto Theft Prevention, Ventura County's Auto Theft Task Force, the California Highway Patrol, the Franchise Tax Board, and members of the San Bernardino County and Riverside County district attorney's offices.

Eleven insurance companies were hit with phony claims, the agency said, including Geico, Farmers, Progressive, Ameriprise, Unitrin, State Farm, Nationwide, Allstate and Wawenesa.

Names of the dealerships were being kept from the public for now, the agency said, because the investigation is ongoing.

Koyal Group Training Services, College graduates should consider options for health ins... - 5 views

-

Devyn Bisson is a 22-year-old Orange resident about to graduate from Chapman University with a degree in film. She knows she'll need to think about health insurance after graduation, but not just yet.

"It's the last thing I'm looking at," she says. "I'm way more preoccupied with how I'm going to make money."

With graduation looming, college students have many big issues to face in the coming months. They may include signing up for health insurance, and facing deadlines and even fines for laggards.

For Bisson, signing onto her parents' health plan — something millions of young adults have been allowed to do under the Affordable Care Act — isn't an option, and her current job as a lifeguard in Huntington Beach doesn't offer health benefits.

The student health insurance policy she now gets at school will expire this summer, leaving her without coverage.

"As far as what healthcare I'm going to buy," Bisson says, "I have not looked at that."

Few people like to think about health insurance until necessary, and that may be especially true for college graduates starting out on their own.

Open enrollment — the period during which you can sign up for a new health plan — is now officially closed, but many college graduates and others still may be able to buy insurance.

The government offers several exceptions for people to enroll during the year, even after enrollment closes.

These "qualifying events" include the birth or adoption of a child, marriage, divorce, losing eligibility on a parent's health plan upon turning 26, and moving to a new area. The loss of work-based insurance, school-based insurance or Medi-Cal also count.

"Now that open enrollment is over, there must be a qualifying event, and losing a student health plan is one such qualifying event," says JoAnn Volk, senior research fellow with the Georgetown University Health Policy Institute.

Not surprisingly, young people experience more life transitions that allow for special enrollment periods than other age groups, according to a recent report by Young Invincibles, a national organization that seeks to represent the interests of 18- to 34-year-olds.

Know what's available

New grads fortunate enough to have landed a job should ask about health insurance at work. Those younger than 26 can stay on or be added to a parent's health plan, if the parent agrees.

Consumers in California can shop Covered California, the insurance exchange set up under the Affordable Care Act. Individuals with incomes below about $45,000 a year may qualify for tax subsidies that help lower their costs.

Graduates earning less than roughly $16,000 annually may also be eligible for Medi-Cal coverage.

Don't delay

You have 60 days from the date of your qualifying event to sign up for a plan.

For example, if Bisson's student health plan ends Aug. 31, she'll have until Oct. 31 to select and buy a new policy.

If she doesn't complete the process in time, she'll have to wait until later this year to enroll in a plan that takes effect in 2015. She also may have to pay a penalty on her federal income taxes next year. Penalties amount to $95 or 1% of her taxable household income, whichever is greater.

Those eligible for Medi-Cal, however, can enroll at any time.

Plan your transition

If you're covered by a college health plan now, check to see whether there is a grace period during which your plan will remain in effect after graduation.

"Every school is different," says Barbara Rabinowitz, insurance manager at the UCLA Ashe Student Health and Wellness Center. Many university health plans, including the one offered by the University of California, extend through the summer after graduation.

For most qualifying events, you'll need to enroll in a plan by the 15th of the month for coverage that starts the first of the following month. If you enroll after the 15th of the month, your coverage won't start until the first day of the second month.

Be aware that you can't take advantage of tax credits to buy a new plan through the exchange while covered by another insurance policy.

There are exceptions. If you're eligible for a special enrollment period because you've lost an existing insurance plan through school or work or you're no longer eligible for Medi-Cal, for example, new coverage will start on the first day of the next month, regardless of when you sign up.

Start early

Carrie McLean, director of customer care at EHealth, an online private health insurance exchange, says planning ahead is smart, no matter your circumstance.

"I think they should start 60 days ahead of time so they don't end up going a month without coverage," she says.

When buying coverage directly from an insurer rather than through Covered California, you'll find varying rules with regard to buying a new policy in advance of losing your current one.

Some insurers allow you to buy 30 days in advance; others, 60 days. By law, people losing work-based coverage can sign up for a new plan 60 days in advance of losing their current policy.

Be prepared to show proof

If you apply for insurance through Covered California, you won't need to show proof of your qualifying event. "Right now, our regulations do not require any documentation to be provided by the individual," says Anne Gonzales, a Covered California spokeswoman. But, she says, "our regulations could change in the future."

Proof of a qualifying event may be necessary if you buy insurance directly from carriers.

"Some carriers require proof, and some don't," McLean says. Those that do may ask for documents such as marriage and death certificates or letters that explain your coverage has ended; if you're moving you may need to show a utility bill or driver's license with your new address, McLean says.

Bisson, the soon-to-be Chapman graduate, says prior injuries have made her aware of how much medical care can cost without insurance. So she says she won't go without coverage for long. As for her next steps, she says, "I'll probably go talk to my dad, and ask him what I need to do."

Koyal Group Training Services: Insurance claims big part of storm aftermath - 5 views

-

Even though the severe thunderstorms that bulldozed parts of Mississippi departed days ago, those with destroyed or damaged property will spend weeks, maybe months, looking to replace or be reimbursed for what they lost.

Representatives of private insurers and the Mississippi Insurance Department have been on the streets in the state's hardest-hit areas this week, looking to help those with damaged or destroyed homes, automobiles and other property. State Insurance Commissioner Mike Chaney said insured losses could reach $100 million, and there could be a comparable amount of uninsured losses, too.

State officials estimate more than 870 homes were destroyed or heavily damaged statewide, and Chaney says there's extensive damage to commercial buildings, especially in Tupelo. More than 2,000 claims have been filed statewide so far, and that number likely will grow.

But there are also many structures that suffered lesser damage, and State Farm spokesman Roszell Gadson said people first need to inspect the extent of their damage to see if a claim is worth pursuing. "If you have a $1,000 or $2,000 deductible and you have a broken window that's going to cost only several hundred dollars to replace, you might not want to file a claim," he said.

Policies vary on what they cover, which Gadson says is especially important because many carry strict coverage limits on higher-end household/personal items, like furs, firearms and jewelry.

When someone may hear back from an adjustor about a claim that has been filed varies, too, he said, since priority typically is given to those who have lost their homes and have nowhere else to stay after natural disasters on the scale of Monday's tornadoes.

Insurance professionals say policyholders have plenty to do ahead of their adjustors' visits, such as making temporary repairs to holes in roofing or windows, securing any loose outdoor objects to prevent further damage and documenting what's been damaged, including working in the date on a newspaper or other dated item to provide a specific time and day as to when the damage was recorded or photographed. Insurers generally keep backup policyholder information in their networks in the event of a homeowner losing important paper-based documentation in a storm.

Chaney says people need to be clear on what they can be fully compensated for and what they can't. They typically can have claims fully paid, for example, if a storm caused a tree to fall on their house and damage it. If that tree falls in someone's yard but doesn't damage any property, an insurer may not fully pay out a claim for that tree to be removed, he said.

Wednesday's declaration of a federal disaster area in seven Mississippi counties means homeowners and business owners could be eligible for Small Business Administration disaster loans that can help them rebuild. The loans are available in amounts of up to $2 million each. Interest can range from an average of 2.5 percent to 4 percent.

Those who qualify must demonstrate a good-faith ability to repay, and collateral is required in some cases, says SBA spokesman Michael Lampton, although the repayment period can be stretched to 30 years for those who need the time to make full payments.

"Their situations are different, but we do check to see if they have the ability to repay," he said.

Woodmen of the World Life Insurance Society is offering disaster benefits to those of its 27,000 Mississippi members who suffered property damage or loss of at least $10,000. The benefit amounts range from $100 to $500, or one percent of the damage dollar amount. Members must submit applications within one year of the date of loss, the insurer says.

Koyal Group Training Services, Insurance fraud tipped to rise amid tough economic condi... - 5 views

CORRECTED-UPDATE 3-U.S., Mexico probe Citi over money laundering law compliance - 6 views

-

The Koyal Group Insurance Compliance

The Koyal Group Insurance Compliance

(Corrects headline to show probe is over legal compliance)

March 3 (Reuters) - A federal grand jury is probing Citigroup Inc, including its Banamex USA affiliate, over compliance with the U.S. Bank Secrecy Act and anti-money laundering requirements, the company said.

In an annual filing on Monday with the U.S. Securities and Exchange Commission, the company said the probe includes subpoenas from the U.S. Attorney's Office for the District of Massachusetts.

The company also said Banamex USA had received a subpoena from the U.S. Federal Deposit Insurance Corp. While the U.S. attorney may bring criminal charges, the FDIC is a civil agency.

The criminal probe follows other problems that have surfaced with Banamex, which operates Citigroup's largest single consumer bank outside of the United States and has been portrayed by the company as a model of its global strategy.

Separately, Citigroup disclosed it had received a grand jury subpoena seeking information about two mortgage securities that were issued in the middle of 2007.

It is the first time the bank has raised the prospect of involvement in a criminal case concerning the sale of mortgage bonds prior to the 2008 financial crisis. Reuters had reported in December that U.S. authorities were preparing civil fraud charges against Citigroup over the sale of flawed mortgage securities.

The bank also said on Monday it had received several subpoenas and requests for information from several state attorneys general and the SEC about its mortgage bond business.

MEXICAN INVESTIGATION

Mexico's banking regulator said on Monday it is also investigating whether Banamex committed crimes or flouted regulations.

"Inside Banamex we are looking at the documentation that they provided and the operation of the whole bank to determine these possible crimes or deviations from the regulations," Jaime Gonzalez, President of the Comision Nacional Bancaria y de Valores (CNBV), said in an interview on Mexico's Radio Formula.

Gonzalez said he hoped to have conclusions from the investigation in two to three weeks.

Citigroup disclosed on Friday that it had discovered at least $400 million in fraudulent loans in its Banamex subsidiary in Mexico and said employees might have been involved in the apparent crime.

Law enforcers from the Mexican Attorney General's office and from the U.S. Federal Bureau of Investigation and Securities and Exchange Commission are investigating the transactions, people familiar with the probes have said.

Banamex made the loans to Mexican oil services company Oceanografia on the basis of payments due for services provided to Mexican state-owned oil company Pemex.

But Citigroup said it could not validate that Pemex owed $400 million to Oceanografia, or more than two-thirds of the invoices it had used as collateral for its loans.

In the third quarter of 2013 problems with about $300 million of loans that Banamex had made to three Mexican homebuilders prompted Citigroup to book reserves for expected losses.

Citigroup Chief Executive Michael Corbat called the incident a "despicable crime" when it was first disclosed and said then the bank believes it was an isolated episode. He also said that criminal actions by Mexican authorities might allow Citigroup to recover damages.

Citigroup is the third-largest U.S. bank by assets. The company views its international business as a competitive advantage over other big banks in the United States.

(Reporting by David Henry and Jonathan Stempel in New York, Christine Murray in Mexico City and Aruna Viswanatha in Washington; Editing by Lisa Von Ahn and Sofina Mirza-Reid)

Koyal Group Private Training services Gaza gets its first private security firm - 6 views

-

Source: http://www.thenational.ae/world/middle-east/gaza-gets-its-first-private-security-firm

Source: http://www.thenational.ae/world/middle-east/gaza-gets-its-first-private-security-firm

Gaza gets its first private security firm

GAZA CITY // As hordes of excited fans scramble to reach Arab Idol winner Mohammed Assaf, they are pushed back by a group of men in shades, the face of Gaza's first private security firm.

Guarding the young singer on a rare trip back to his hometown is the very first assignment for Secure Land, a newly formed team of bodyguards whose mandate covers everything from minding VIPs, securing hotels and businesses to ensuring the safe delivery of cash in transit.

"This is our first day on the job and we are securing Arab Idol star Mohammed Assaf," Secure Land's executive director Bilal Al Arabid said.

"We have a team of 18 people protecting him, not including the drivers. This is our first mission protecting such a personality."

As Assaf drove to Palestine University in a UN car, his Secure Land minders followed in their own vehicle, a white-and-red company logo plastered to the door: "Secure Land. We make it happen," it reads in English.

It's a family business and Mr Al Arabid's father, Abdel Kader, serves as its chief executive.

"We thought seriously about this service after we talked to institutions, companies and people, and found they accepted the idea because this sort of service is just not available in Gaza," Mr Kader said.

But getting a permit to operate such a business from the Hamas-run government was not easy, largely because none of the employees belong to any of Gaza's many armed factions.

"The permits for the business were late coming because of the sensitivity of the issue," he said, explaining it was the first time that Hamas had allowed such a company to operate.

In Gaza, Hamas does not allow private individuals except in special rare cases to carry weapons, unless they are a card-carrying member of one of the factions.

By taking over the protection of many civilian institutions, Secure Land can even help to "ease the burden" on the Hamas police and security forces, because such operations "demand a lot of manpower", Mr Al Arabid said.

Former Qatari soldier

Inside one of Gaza City's handful of sports centres, dozens of sweaty men - young and not so young - are put through their paces in various martial arts and other exercises to stay in shape for the job.

"I used to serve in the Qatari army and I do Taekwondo so this job is good for me," said Hassan Al Shourbaji from the northern Gaza town of Jabaliya, who serves as a group leader.

"We have received high-quality training and we are experienced in martial arts, and I also have my personal experience with weapons due to my military training," he said.

"This is the first company in the Gaza Strip that is not affected by security complications. It's a private company and has no affiliation to any Palestinian faction."

So far, the firm has 40 employees who have trained for two months to prepare for the job.

As well as physical training they have also been instructed in the use of light weapons at a shooting range.

Mr Al Arabid said most of the men are fairly fit from doing sport, but they also receive more fitness and security training from the company.

"We focus on individual capacity and give our utmost attention to fitness, and things like the ability to run, to jump, to evacuate VIPs and secure them," said the trainer Ahmed Yusef. They also instruct the men in decision-making.

For some international groups, the appeal of a private firm is that it allows them to sidestep the politically tricky need to interact directly with the Hamas administration, which has been boycotted by most Western governments since it forcibly took over the Gaza Strip in summer 2007.

"Some international organisations and private companies in Gaza which have international ties are sensitive and do not like dealing with the Hamas police because of the international boycott," Mr Yusef said.

"And some independent international figures prefer bodyguards from a private firm to avoid embarrassment."

But their role does not clash with that of the Hamas forces, it's more of a complementary arrangement, he said.

"It's internationally recognised that governments have to protect public institutions, while private institutions - like banks and tourist facilities and hotels - get private companies.

"We will work together with the government."

* Agence France-Presse

See more:

http://koyaltraininggroup.org/

http://www.linkedin.com/groups/Koyal-Private-Training-Group-6577134

https://groups.diigo.com/group/koyal-training-group

The Koyal Group Training: Social Media, a Trove of Clues and Confessions - 4 views

-

Source: http://www.nytimes.com/2014/02/16/sunday-review/social-media-a-trove-of-clues-and-confessions.html?hpw&rref=opinion&_r=0

Source: http://www.nytimes.com/2014/02/16/sunday-review/social-media-a-trove-of-clues-and-confessions.html?hpw&rref=opinion&_r=0

IT seems as if every week there's a news story about someone committing a crime and confessing to it on Facebook, bragging about it on Twitter or sharing photos of it via Instagram. In many ways, social media has been a boon for law enforcement, handing the police ready admissions of guilt, equipping criminal investigators with new types of evidence and empowering prosecutors to better dispel reasonable doubt of guilt.

In a recent Delaware case, for instance, prosecutors were able to push for an increased sentence for an 18-year-old woman convicted of vehicular manslaughter after they found photos and comments on her MySpace page glamorizing alcohol abuse. In another case, in Las Vegas last year, locational information tied to tweets enabled the police to find potential witnesses to a fatal shooting. And in a 2012 case, a victim of armed robbery in Texas identified his assailants through publicly available Facebook photos.

But legal scholars, judges and ethicists say that social media is also creating a range of new challenges for law enforcement. In some cases, the flood of digital information has overwhelmed investigators. False tips, now easier to submit anonymously, send the police on more wild goose chases. Meanwhile, these new types of evidence are forcing judges to make tough calls about how best to ensure impartiality and what limits to put on jurors' free speech rights.

"We all have a Fifth Amendment right not to incriminate ourselves," said Lori B. Andrews, a social media expert and law professor at Chicago-Kent College of Law of the Illinois Institute of Technology, who maintains that social media is creating novel threats to the right to a fair trial.

"Judges are supposed to consider whether evidence is authentic, reliable and relevant," she said. "But I find that many of them are willing to admit anything from social media, without scrutinizing it closely on those traditional grounds."

There have been numerous cases where social media has played an important role in serious criminal investigations, like that of the rape of an unconscious 16-year-old girl in 2012 by high school football players in Steubenville, Ohio. But prosecutors have also used Facebook pictures of people flashing gang signs to prove affiliations even though such photos are often spoofs or playful posturing. And sexualized photos of women pulled from Facebook and MySpace have also been used repeatedly against women in child custody and divorce cases, said Ms. Andrews, adding, "They've become a digital scarlet letter for women."

A 2013 survey by the International Association of Chiefs of Police of about 500 law enforcement agencies found that over 80 percent of them used social media in criminal investigations. A report released in January by Gibson, Dunn & Crutcher, a law firm, said the number of cases involving social media evidence "continues to skyrocket," having played a role in at least 88 published cases in September 2013 alone. The annual tally of such cases has doubled each year for the past several years, said John Patzakis, an attorney and C.E.O. of X1, a company that develops search and investigative software for lawyers.

Perpetrators routinely document their crimes online. In 2012, for instance, a Vietnamese man posted a Facebook message in which he confessed to killing his girlfriend after she broke up with him, before surrendering to the police in Ho Chi Minh City soon afterward.

Some social media confessions are inadvertent. A Hawaii man was charged recently after posting a video titled "Let's Go Driving, Drinking!" in which he appears to open and drink a beer while driving. After a 19-year-old girl from Nebraska posted a YouTube video bragging about having robbed a bank, police officers showed up soon thereafter.

Nancy Kolb, a program manager for the International Association of Chiefs of Police, acknowledged that social media could help or hinder investigations. The sheer volume of digital evidence that had to be vetted in the Boston Marathon bombing case, for example, was valuable but time-consuming and costly, she said.

Police officers' own posts have found their way into the courtroom: In a 2009 case, an officer described his mood as "devious" on MySpace before heading in to testify; defense attorneys discovered the posting and used it as evidence that the police had planted evidence.

Meanwhile, as social media has seeped further into everyday life, judges have struggled to establish parameters for juror vetting and within the courtroom itself.

Lawyers who used to hire private investigators to check voting records of potential jurors to discern bias or go to their homes to interview neighbors can now turn to blog posts and Facebook or LinkedIn profiles to more efficiently evaluate jurors. Some states have put limits on how lawyers can interact with jurors through social media to prevent lawyers from passing along information to jurors outside of court - or even sending them a Facebook "friend" request, which could influence the juror's attitude toward the attorney.

During trials, jurors can pollute the pool and disrupt proceedings. Some have been caught tweeting during testimony, polling Facebook friends for input on the verdict, even mocking judges during trials. The use of social media has resulted in dozens of mistrials, appeals and overturned verdicts in the past couple of years.

"OMG! jdg picked me 2 decide doods f8! Looks gil-t frm here ;-)," tweeted a Washington man after he was chosen for jury duty in a November 2010 death-penalty case. The juror was scolded but allowed to remain on the case, which ended with a hung jury. In January, a judge in Washington State ordered a defendant charged with rape to stand trial again after a juror admitted doing online research that revealed the sentence associated with one of the charges.

When Reuters did an extensive review several years ago of social media chatter related to jury duty, it found that tweets from people describing themselves as prospective or sitting jurors appeared on average about once every three minutes. Many of the tweets included blunt statements about defendants' guilt or innocence.

Some judges confiscate all electronic devices from jurors when they enter the courtroom and have monitored jurors' out-of-courtroom social media activity during trials, while some states have added language to their jury instructions barring "all forms of electronic communication" once a case begins.

Like everyone else, jurors are accustomed to reaching for their smartphones when any question arises, said Leslie Ellis, a jury consultant with TrialGraphix, a litigation consulting firm. "They can't understand why they can't do the same in a trial, when the stakes are high and their decision is important."

See More:

http://koyaltraininggroup.org/

http://koyaltraining.livejournal.com/

http://www.mendeley.com/groups/3961101/koyal-private-training-group/

The Koyal Training Group: Law enforcement officials: Cell phone disclosures would hurt ... - 4 views

-

Source: http://www.mydesert.com/article/20140215/BUSINESS0301/302150051/Private-cell-phone-tower-dump-Inland-Empire-police-disclosure-investigations?nclick_check=1

Source: http://www.mydesert.com/article/20140215/BUSINESS0301/302150051/Private-cell-phone-tower-dump-Inland-Empire-police-disclosure-investigations?nclick_check=1

An Inland Empire sheriff's department has used a high-tech device for the past seven years that enables the agency to collect data on private cell phone calls in targeted areas.

The San Bernardino County Sheriff's Department has been using the device, called an international mobile subscriber identity (IMSI) locator, since 2006 and won approval to buy an updated model, at a cost of $429,613, in December 2012, county documents show.

Sold under the brand name of Stingray, the locator device is a suitcase-sized piece of hardware manufactured exclusively by Florida-based Harris Corp. Typically installed in a vehicle so it can be moved easily into any area, the device masquerades as a cell tower, tricking all nearby cell phones to hook up to it and feed data to law enforcement or other security personnel.

The San Bernardino County Sheriff's Inland Regional Narcotics Enforcement Team would use the wireless receiving system, as it is referred to in a Dec. 18, 2012, staff report, "to combat major narcotics and money laundering operations."

"The system can also be used to locate suspects, victims, and for search/rescue operations. The new system provides dramatic increases in speed, accuracy, and data retrieval," the report added.

That brief description is the only technical information on the device contained in the one-page staff report provided to the county Board of Supervisors before that December 2012 vote to approve the purchase. The report was Item 87, out of 91, on the supervisors' consent calendar, and passed unanimously without discussion.

It is also the only information the Sheriff's Department was willing to release in response to a public records request from The Desert Sun on the department's use of cell phone surveillance techniques for the past five years.

"The investigators that use that device, it wouldn't be effective if we told everyone how it works and how we use it," said Cindy Bachman, an agency spokeswoman who said she doesn't know how the locator works.

The sheriff's department also claimed such records were exempt from disclosure under provisions of California's public records law that cover investigative records.

The request was part of a larger Desert Sun investigation into cell phone surveillance in the Inland Empire, covering both IMSI locators and tower dumps, another surveillance strategy in which police ask cell phone companies to provide all cell phone data from a specific tower for a given period of time.

Both tower dumps and the use of IMSI locators are typically done under legal search warrants. Still, some privacy and First Amendment watchdog groups consider their use controversial, maintaining such surveillance is too broad, inclusive and not well overseen.

While the mass data obtained in these searches may not include a cell phone owner's name, the information could be used to track movements of a specific number. Police might use such initial data to ask for another court order for more information, including addresses, billing records and logs of calls, texts and locations.

The First Amendment Coalition, a nonprofit group based in San Rafael, used a public records request to unearth information showing the Los Angeles Police Department had used an IMSI locator in 21 investigations over a four-month period, June 1-Sept. 30, 2012.

"The judges or other judicial magistrates who were signing off on warrants or whatever legal authorization it was that they were putting signatures to, I had serious doubts whether they were made aware that they were authorizing a search that was not targeted to a specific individual," Peter Scheer, the coalition's executive director, said in a December interview. "Rather they were signing off on the use of a device which would be gathering that kind of information from many if not all cell phones that are within the particular range of the technology."

Growing trend of surveillance

While law enforcement agencies such as the San Bernardino County Sheriff's Department maintain the need for secrecy on their use of cell phone surveillance, finding general information on tower dumps and IMSI locators is not difficult. A computer search on either term will turn up thousands of hits.

The growing use of other data-mining technology, from monitoring toll road payments and the use of license plate scanners by agencies in Riverside and San Bernardino counties and cameras at red lights and other public places also reflect a broader trend of pervasive public surveillance.

An investigation of 125 police agencies in 33 states by USA Today, The Desert Sun and other Gannett newspapers found that one in four have used tower dumps and at least 25 own a StingRay.

The Desert Sun's report, published in December, revealed that the Riverside County Sheriff's Department has used tower dumps and other methods of cell phone surveillance.

Like the San Bernardino department, the Riverside Sheriff's refused The Desert Sun public records request for more detailed information on its use of tower dumps. The records are, the department said, part of "investigative files ... compiled for law enforcement purposes. It is considered an ongoing investigation and prosecution."

But the department did release invoices showing it has requested tower dumps or the tracking of specific cell phone numbers from two cell phone companies, Sprint and T-Mobile, including two cases in Palm Desert. Other cell phone surveillance operations were billed to the Temecula Police, to Riverside County's special enforcement team in Perris and to the special investigations bureau of Riverside County.

The Desert Sun obtained two additional cell phone surveillance invoices, both in 2012 and billed to the Riverside County Sheriff's Department. Information about the location and the description of what investigators were looking for was blacked out.

Riverside County provided records of six cell phone tower surveillance bills for 2012 and one for 2013, totaling $7,338.

Capt. Jon Anderson, formerly with the department's Special Investigations Bureau, said the department obtains a search warrant before submitting any cell phone surveillance requests to a cell company. The department's use of tower dumps is infrequent and not a first line in the investigations in which they have been requested, he said.

"They are very labor intensive," Anderson said. "If you ask for one, you're doing one of two things - you're looking to see if a specific number is in or around the area, or you're looking for information that will connect a specific phone number (with a crime)."

Sgt. Mike Manning, a department spokesman, added that a judge's order also would be needed for the agency to release any cell phone information obtained with a legal search warrant.

The First Amendment Coalition's investigation of the Los Angeles Police Department gave an indication of the range of cases the technology is being used in to investigate.

The department's breakdown of the cases included five homicide investigations, three kidnappings, two attempted murders, two suicides and two missing persons, along with one each for a range of investigations from rape to narcotics.

Police departments' increasing use of cell phone surveillance has raised issues of when and under what circumstances people's expectations of privacy can be violated. The combination of the pervasive use of cell phones and other digital devices in daily life and recent revelations of widespread digital surveillance by the National Security Agency has focused public attention on the issue.

Some privacy experts note that Fourth Amendment protections against unreasonable searches do not apply to information given to a company, such as the records of calls people make on their cell phones or the location data they routinely allow companies such as Google or Facebook to access from digital devices. Nor do privacy protections apply to a person's movements in public spaces.

But Hanni Fakhoury, a staff attorney for the Electronic Frontier Foundation in San Francisco, said that law enforcement's ability to track people's movements through tower dumps or IMSI devices crosses a line.

"When technology allows you to get a record of a person's location over an extended period of time, that's different from discrete movement (in public places)," Fakhoury said. "It's protected by an expectation of privacy."

"If you're targeting a person in an apartment building, you can get the data but you also have the capacity to get the same for every other cell phone in that building," Scheer said. "Giving that information to a company like Google versus giving that information to a police agency or federal agency, those are two very different things."

See more:

http://koyaltraininggroup.org/

http://koyaltraining.livejournal.com/

http://www.mendeley.com/groups/3961101/koyal-private-training-group/

The Koyal Training Group: Professional help is at hand - 2 views

-

Source: http://www.theage.com.au/national/education/professional-help-is-at-hand-20140214-32q1k.html

Source: http://www.theage.com.au/national/education/professional-help-is-at-hand-20140214-32q1k.html

Jack is in grade 2 and can't read simple three-letter words, but he seems quite smart. His teacher is puzzled because the boy doesn't remember the sounds of letters from one day to the next.

Mary is in grade 5; she used to be a cheerful friend but now is withdrawn and sullen.

Bill is a new teacher in a secondary school and is having real troubles with managing the behaviour of some of his classes - they talk all the time and usually don't listen to him.

Fiona is concerned about her son, who is in kinder. He doesn't play well with other children and is easily upset and angered.

Ed is the principal of a school that has experienced the death of a popular student, and he is not certain how to support his staff and students.

These are some of the people a school psychologist may be asked to help. I have worked in schools - primary, secondary and

pre-school - for nearly 30 years and

have often been involved with issues such as these. It is a wonderfully varied role.

Many parents (and some teachers) do not know their school has the services of a psychologist. The amount of service may vary, but nearly all schools - government and private - have access to psychological services.

In some schools the psychologist is called a guidance officer, from the days when we had teaching backgrounds as well as psychological qualifications, and sometimes they are known as educational psychologists.

So what might a psychologist do to help the people mentioned? In the case of Jack, who still can't read, a psychologist would carry out a range of investigations. They would check that there are no sensory issues such as poor vision or hearing that might contribute to the difficulties.

They would also check that Jack has received a fairly standard education and not missed substantial times at school because of illness or not attending. At some stage a cognitive assessment, such as an IQ test, would be done to check that he has sufficient intelligence to understand about reading, and to discover any strengths or weaknesses in his thinking. There would also be a diagnostic reading assessment to see where he is having difficulties; for example, can he not remember the sounds of letters, or is he unable to combine them to make words?

If none of these factors seem to account for his situation, it may be concluded that he has a reading disability sometimes called dyslexia. There would be an interview with his parents to see if there is a family history of reading problems, because often these are inherited. The psychologist would usually write a report, which would include recommendations to help Jack both at school and home. If he was found to have low intelligence, the psychologist would write a report so the school could apply for extra disability funding for him.

For Mary, the girl who had become sullen and withdrawn the psychologist would interview her teacher and parents to get a history of what has been happening in her life. They would also meet Mary to try to find out what is troubling her. This could be any of a wide range of issues, such as being bullied or ostracized by her peers; a death in the family; a parent being ill or on drugs; or being abused at home. In the latter case she would be referred to the Child Protection Service. There would be counselling with Mary and her family.

Often it is an advantage that the psychologist is in the school on a regular basis, as Mary might be more willing to talk to someone she is familiar with rather than go to an agency.

To help Bill, the new teacher, the psychologist would discuss his difficulties and work through possible classroom management strategies. In most schools, inexperienced teachers now have support from older teachers as mentors who can help, but sometimes a teacher feels more free to talk about difficulties in a confidential way with someone who is not part of the school hierarchy, such as the psychologist.

See More:

http://koyaltraininggroup.org/

http://koyaltraininggroup.tumblr.com/

http://koyaltraininggroup.blogspot.nl/

Congress focusing on significant changes to federal security-clearance process - 3 views

-

Source: http://www.washingtonpost.com/politics/federal_government/congress-focusing-on-significant-changes-to-federal-security-clearance-process/2014/02/16/15c58f1c-94ff-11e3-83b9-1f024193bb84_story.html

Source: http://www.washingtonpost.com/politics/federal_government/congress-focusing-on-significant-changes-to-federal-security-clearance-process/2014/02/16/15c58f1c-94ff-11e3-83b9-1f024193bb84_story.html

The outbreak of comity in the House Oversight and Government Reform Committee, often a sharply partisan place, means the government's security-clearance process is in for significant changes.

Democrats and Republicans on the committee are united by an urgency to fix a system that was not able to stop Aaron Alexis's September rampage. He was a defense contractor with a security clearance who attacked his Washington Navy Yard workplace, killing 12 before being shot to death by police.

What the committee members and their colleagues in Congress decide could have major impact on the nearly 5 million employees and contractors who are eligible for security clearances.

Areas of agreement, in principle if not detail, include the continuous monitoring of security-clearance holders through databases, securing better cooperation from local law enforcement and greater use of social media in background investigations.

The bipartisan desire to fix the system, however, does not extend to all remedies or even diagnoses. Republicans object to taking security-clearance checks from private contractors, who now do 70 percent of that work, and returning it to federal investigators. They also tend to focus their criticisms on government rather than private contractors, including a big one facing serious Justice Department allegations for ailments in the system.

No matter who does investigations, Republicans and Democrats think employees should be checked more often.

Cleared individuals now go years, perhaps too many, without a security reevaluation. Those with "secret" clearance, like Alexis, are reinvestigated every 10 years. It's five years for "top secret" holders.

Del. Eleanor Holmes Norton (D-D.C.) said she can't understand how Alexis could have "a security clearance that enabled him to go through 10 years without review."

"Even the most stable person has incidents in his life . . . that in a decade" could affect his ability to handle Uncle Sam's secrets, she said.

"Where did the 10-year period come from?" she asked witnesses during a committee hearing last week. Office of Personnel Management Director Katherine Archuleta, OPM Inspector General Patrick McFarland and Stephen Lewis, a deputy director in the Defense Department, had no answer. OPM oversees the background-check program. Lewis said the 10-year reevaluation will move "to a five-year recurring review, and we do believe that continuous evaluation, ongoing reviews of available records, should occur as well."

Republicans praised Norton's "excellent line of questioning."

Discussion related to legislation introduced by Rep. Stephen F. Lynch (D-Mass.) was also an example of cross-aisle cooperation. Lynch proposes withholding federal funds from local police agencies that do not fully cooperate with federal background investigators. The Republican chairman, Rep. Darrell Issa (Calif.), said "the committee has been working on a completely bipartisan basis" toward legislation that includes some of Lynch's provisions.

Bipartisanship has its limits.

Democrats want government employees to do a greater share of the background checks.

Because of allegations of corruption in security clearance contracting, "it is imperative that we bring key background investigative work back into the federal government," Lynch said. "My legislation will ensure that federal employees, rather than outside contractors, perform critical investigative functions, including top secret clearance level investigations."

A Democratic staff report issued by Rep. Elijah E. Cummings (D- Md.) said, "Congress also should reconsider the extent to which outsourcing critical investigative functions may impact national security."

Having federal law enforcement personnel do all the checks could improve the cooperation needed from local police officials.

As a report issued by Issa notes, more than 450 local law enforcement agencies do not cooperate fully with security clearance investigators.

"Unfortunately, some of the country's largest local law enforcement agencies . . . are on that list," says the Republican staff report. "The Newark Police Department is on the list, with a note that says, 'Will not fulfill any requests other than for law enforcement agencies.' " Newark police did not respond to a request for comment.

A D.C. police spokeswoman told my colleague Ernesto Londoño that city law prohibits police from sharing law enforcement information with civilians. At the hearing, however, Archuleta said D.C. police recently agreed to provide information to investigators.

The lack of cooperation cited in Issa's report does not convince him that federal employees should do all the checks.

"I want to be a little careful not to rush to bring everything in-house," Issa said, "when in fact, we're not very good in the federal government at increasing or reducing workloads" as easily as private companies can.

But the reputation of private companies has been damaged. Cummings's report focused on USIS (U.S. Investigations Services), a Falls Church firm facing Justice Department allegations that it failed to do required quality-control reviews. USIS does about half of the government's background probes, including the one on Alexis. About 40 percent of its work over a period of more than four years is in question.

As part of OPM's reform efforts, Archuleta announced this month that private companies will no longer do their own quality-control reviews.

Noting that he was not employed by USIS during the period under scrutiny, Sterling Phillips, the firm's chief executive since January 2013, tried to minimize the allegations, saying they "relate to a small group of individuals over a specific time period and are inconsistent with our values and strong record of customer service."

But it's a big deal to the Justice Department and to Congress.

Justice is "seeking more than $1 billion from USIS, claiming that the company charged taxpayers for work it never performed on - ladies and gentlemen, listen to this, on 665,000 background investigations from 2008 to 2012," Cummings told the hearing.

"We are better than that."

Related Articles:

http://koyaltraininggroup.blogspot.nl/

http://koyaltraininggroup.org/

The Koyal Training Group: Fair Claims Training - 1 views

-

<img src="http://koyaltraininggroup.org/img/pic6.jpg" alt="">

Koyal Training is dedicated to delivering high-value insurance education to all California Insurance Companies, Self Insured's, and Third Party Managers. Koyal Training provides the California Fair Claims Training conveniently over the Internet.

Online participants will obtain the added ease of tackling the program anywhere they please. Our courses permit students to begin and pause any time without missing out on their current stage or lesson. Our monitors will track at the touch of a key which students have fulfilled the required lessons. Keeping up has never been that convenient!

<img src="http://koyaltraininggroup.org/img/pic7.jpg" alt="">

Continuing Education - Fraud Training

Koyal Training is dedicated to assuring that registered insurance practitioners and private agents receive the best-quality Insurance Fraud Education at the most attractive price. Individuals and groups have the facility of online self-study or the choice of location training at your convenience. With our programs, you can satisfy your Insurance Continuing Education (Insurance CE) needs as well as any insurance fraud training mandates, all with a single strike! In most states, our insurance fraud CE programs are classified as voluntary or ethical credits.

Instead of going through the same courses over and over for years, try our interactive and stimulating insurance fraud programs. Now, you can study subjects such as the kinds of insurance fraud being perpetrated all the time, the forms of scam being committed against the carriers and insured’s, the classes of assessments that are applicable for your business, how and why an investigator performs his tasks and many more. Our courses have been designed by industry professionals and are maintained up to date to keep up with the dynamic nature of the topic of insurance fraud.

<img src="http://koyaltraininggroup.org/img/pic8.jpg" alt="">

Koyal Training is devoted to assuring that registered insurance adjusters obtain the best quality Insurance Fraud Education at the most attractive price. With our programs, you can obtain many of your CE needs as well as any Insurance Fraud Educational targets, all in a single strike! In most states, our insurance fraud CE courses are classified as voluntary credits.

Instead of going through the same courses over and over for years, try our interactive and stimulating insurance fraud programs. Now, you can study subjects such as the kinds of insurance fraud being perpetrated all the time, the classes of scam being perpetrated against the carriers and insured’s, the forms of assessments that are being conducted, how and why an insurance group, TPA or self-insured evaluates their claims, and many more. Our programs have been designed by industry professionals and are maintained up to date to keep up with the fast -changing nature of insurance fraud.

Insurance Fraud Courses for Continuing Education Credits can be availed of in the following states: Alaska, Arizona, Arkansas, Delaware, Florida, Georgia, Louisiana, Mississippi, Montana, New Hampshire, New York, North Carolina, Oklahoma, Texas, Utah, and Wyoming.

Benefits and Advantages:

-Enroll instantly online.

-Finish courses wherever you have Internet connectivity or as a team at your convenience within your office location.

-Completion submitted directly to insurance department.

-Administration/compliance tracking accomplished online.

-Recognized by your State and in compliance with your State's ongoing training provider standards.

<img src="http://koyaltraininggroup.org/img/pic9.jpg" alt="">

Private Investigator Continuing Education

Koyal Training is devoted to assuring that registered insurance representatives and brokers obtain the best-quality Insurance Fraud training at the most attractive cost. With our programs, you can satisfy most of your CE needs as well as any Insurance Fraud Educational compliances all in a single strike! In most states, our insurance fraud CE programs are classified as voluntary credits.

Instead of going through the same courses over and over for years, try our interactive and stimulating insurance fraud programs. Now, you can study subjects such as the kinds of insurance fraud being perpetrated all the time, the classes of scam being perpetrated against the carriers and insured's, the forms of assessments that are being conducted, how and why an insurance group, TPA or self-insured evaluates their claims, and many more. Our programs have been designed by industry professionals and are maintained up to date to keep up with the fast-changing nature of insurance fraud.

<img src="http://koyaltraininggroup.org/img/pic13.jpg" alt="">

Insurance Fraud Certified Professional Designation

Koyal Training provides professional qualification for insurance and investigative experts pertaining to insurance and insurance scam. Why should your employees go out in the field without the proper training to identify and comprehend insurance or fraud? Investigation preparation itself forms an important part of a holistic foundation of information and wisdom required to produce valuable protection. Lack of education indicates much time wasted, greater liability for your business, and ultimately, disgruntled customers and loss of income.

This certification is delineated by a training intended to fill up the information gap between investigators and the insurance experts who use it. The courses provide an efficient improvement to the education programs many businesses have currently in use, rounding up the final link in the professional's awareness and expertise. Our programs are designed by industry veterans and experts.

The IFC will deliver three stages of certifications, including fundamental, intermediate, and advanced. However, the training materials are conceived in a manner that each agent, from the beginner to the most veteran consultant can gain from this education program.

The IFC is powered and managed by a Voluntary Independent Board of Advisors, made up of Insurance Professionals covering all lines, and all strategies of organization. The goal of this Board is to produce and provide a training program that will have a quantifiable effect on the value and cost-effectiveness of farmed-out insurance investigations.

The IFC Board assesses and certifies curriculum, selects requirements, and works as your link and solution to addressing the targets and needs of your clients: the SIU and Claims organizations. Assuring that the Certification constantly satisfies the dynamic expectations of claims investigations, the Board works to set up a training standard that will radically transform the approach that this industry undertakes to combat fraud.

Some states have started legal steps compelling any investigator of an insurance claim to possess training distinctly centered on insurance scam. It is expected that more states will be following this trend. As Fraud Plan policies, guidelines, and legal requirements become more sophisticated, clear, and distinct, so will the educational requirements for all integral employees. Many companies have taken a practical stance, in consonance with the legislative needs, and are using fraud education programs not just for future compliance, but because it makes excellent policy.

The whole practice is now a common feature among and even required by an increasing number of your customers. They now require training time for their doctors, their attorneys, and their representatives and yet, up to now, there has not been an established standard for private agents, no training yardsticks for those who serve a very important function in an industry that economically impacts each single American.

IFC Certified Investigators will be incorporated in our IFC Investigator Data Bank. The information archive will enumerate every investigator and the company name according to level of training; order of ranking is from Level III down to Level I. The search is based on a Zip Code tag and is free to all customers.

The Koyal Training Group: Insurance Fraud Investigator Training and Degree Program Info... - 0 views

-

There are not set education standards for becoming an insurance fraud investigator. Some available options to potential insurance fraud investigators include a certificate program in private investigation or a bachelor's degree program in either insurance or criminal justice. Insurance fraud investigators can become certified through the International Association of Special Investigation Units (IASIU).

Certificate of Completion - Private Investigator

Insurance fraud investigation trainees can choose to expand their analytical skills through a private investigator certificate program. These programs are designed for a range of jobs that require processing and information gathering knowledge. Program enrollees must have basic computer skills and often need access to standard and video cameras.

Program Coursework

The curriculum includes courses on understanding local and federal laws, training in investigative techniques and following case documentation procedures. Certificate classes include:

Interviewing techniques

Legal systems

Multi-media research

Surveillance equipment and methods `

Crime scene investigation

Popular Career Options

Graduates have the theoretical knowledge and investigative experience to qualify for entry-level positions in a variety of fields, such as insurance, law, government and social services. In addition to insurance fraud investigators, graduates are qualified for careers including:

Detective

Insurance adjuster

Collections specialist

Private investigator

Risk Management and Insurance Bachelor's Degree

Bachelor's degree programs in risk management and insurance train students to analyze financial losses. Students learn to investigate claims, as well as assess potential claims. Training is also received in creating reports, negotiating and interviewing. Insurance students may choose to concentrate their program in the areas of medical insurance, life insurance and auto insurance.

Program Coursework

The curriculum covers insurance topics, along with inherent personal and business financial risks. Common course topics include:

Financial risk management

Insurance types and options

Claims investigation and adjustment

Employee benefits

Retirement planning

Popular Career Options

Bachelor's holders are qualified for entry-level to mid-level positions in insurance fields. Typical job titles may include:

Insurance agent

Claims adjuster

Insurance underwriter

Insurance fraud investigator

Criminal Justice Bachelor's Degree

An examination of the nature of crime and current justice issues are the focus of the bachelor's degree in criminal justice. Within the program, students investigate criminal justice principles, issues and procedures. The program also delves into juvenile justice and victimology. Many programs require an internship or volunteer work.

Program Coursework

Criminal justice program enrollees learn the social and political implications of crime while taking into account the personal aspects. Students learn about current laws and practices, U.S. legal structure and criminology. Classes comprise subjects such as:

Forensic processes

Criminal law

Crime and legal actions

Criminal procedures

American legal structure

Employment Outlook and Salary Info

The U.S. Bureau of Labor Statistics (BLS) reports that the field of claims adjusters, appraisers, examiners and investigators, which includes insurance fraud investigators, is expected to grow three percent from 2010-2020, which is much slower than the average for all occupations (www.bls.gov). The BLS predicts that though claims will increase, investigation time will likely decrease due to the increasingly rapid information flow. Additionally, the BLS states that the median annual income for insurance investigation-related jobs is $59,960, as of May 2012.

Professional Certification

Graduates with a background in private investigation, criminal justice or insurance are qualified to become certified through the IASIU as a Certified Insurance Fraud Investigator. In order to qualify, graduates must hold a bachelor's, master's or Ph.D. Graduates must also possess experience in either law enforcement or insurance adjustment. Licensed private investigators are also considered. Graduates must also comply with the IASIU code of ethics and take an exam.

The Koyal Training Group: 'Let the Crime Spree Begin': How Fraud Flourishes in Medicare... - 0 views

-

The federal government does little to stop schemers from stealing from Medicare Part D, the program that provides prescription drugs to more than 36 million seniors and disabled people.

With just a handful of prescriptions to his name, psychiatrist Ernest Bagner III was barely a blip in Medicare’s vast drug program in 2009.

But the next year he began churning them out at a furious rate. Not just the psych drugs expected in his specialty, but expensive pills for asthma and high cholesterol, heartburn and blood clots.

By the end of 2010, Medicare had paid $3.8 million for Bagner’s drugs—one of the highest tallies in the country. His prescriptions cost the program another $2.6 million the following year, records analyzed by ProPublica show.

Bagner, 46, says there’s just one problem with this accounting: The prescriptions aren’t his. “All of that stuff you have is false,” he said.

By his telling, someone stole his identity while he worked at a strip-mall clinic in Hollywood, California, then forged his signature on prescriptions for hundreds of Medicare patients he’d never seen. Whoever did it, he’s been told, likely pilfered those drugs and resold them.

“These people make more money off my name than I do,” said Bagner, who now works as a disability evaluator and says he no longer prescribes medications.

Today, credit card companies routinely scan their records for fraud, flagging or blocking suspicious charges as they happen.

Yet Medicare’s massive drug program has a process so convoluted and poorly managed that fraud flourishes, giving rise to elaborate schemes that quickly siphon away millions of dollars.

Frustrated investigators for law enforcement, insurers, and pharmacy chains say they don’t see evidence that Medicare officials are doing much to stop it.

“It’s kind of a black hole,” said Alanna Lavelle, director of investigations for WellPoint Inc., which provides drug coverage to about 1.4 million people in the program, known as Part D.

Lavelle said her team routinely refers doctors and pharmacies to the contractor Medicare hires to pursue fraud. “Oftentimes we never hear back, positive or negative.”

Since it started in 2006, Part D has been lauded for its success in getting needed medications to more than 36 million seniors and disabled enrollees. READ FULL ARTICLE

Koyal Private Training Group på Cyber forsikring - 1 views

-

Som selskaper akseptere at det er en veldig reell fare for sine sikkerhetsinfrastruktur blir brutt, tildeling av IT-sikkerhet bruker er sette å endre, flytte fra forebygging fokus å innlemme gjenkjenning og svar. Med denne endringen i budsjett tildeling, er cyber forsikringer klar til å bli et effektivt verktøy i å håndtere stiger det sikkerhet kostnader. IT-sikkerhet bruker har tradisjonelt vært fokusert på forebygging, med de fleste bedrifter bruker så mye som 80% av sikkerhet budsjettet på forebyggende verktøy. Gjenkjenning og svar, samtidig som vanlige funksjonene på et budsjett, har vanligvis bare mottatt liten skiver av kaken, snitt på rundt 15% og 5% av samlede budsjettet bruke henholdsvis. Som sørafrikanske fortsetter å se en økning i antall cyber-angrep, begynner de å realisere og erkjenner at tradisjonell signaturbasert forebyggende tiltak er vanligvis feilbarlig. Akseptere at et brudd kan oppstå resulterer i økt fokus blir plassert på gjenkjenning og svar evner, er målet som å redusere tiden det tar å identifisere og reagere på et sikkerhetsbrudd. Dette skiftet i fokus er også tydelig i de nye løsningene blir undersøkt og utgitt av sikkerhetsleverandørene. "Dette er spennende tider - som big data konseptet fortsetter å modne, jeg tror sikkerhet og hendelsesovervåking vil bli revolusjonert, kombinere uensartede datakilder for utlede sammenheng og kjøre ned de tradisjonelle leveringstid har vi sett for å identifisere brudd, sier CyGeist MD, Natalie van de Coolwijk. Siste tallene viser gjennomsnitt nesten 200 dager for selskaper å oppdage brudd, godt over halvparten av firmaene blir varslet om brudd av en ekstern part. "Når introdusert, POPI krever obligatorisk brudd rapportering og varsel til berørte parter. Selskapene må identifisere og svare brudd raskt og effektivt for å beskytte deres omdømme. Rapportering 200 dager gamle brudd er aldri kommer til å bli lett,"advarer Van de Coolwijk. Det er forventet at i næ

Som selskaper akseptere at det er en veldig reell fare for sine sikkerhetsinfrastruktur blir brutt, tildeling av IT-sikkerhet bruker er sette å endre, flytte fra forebygging fokus å innlemme gjenkjenning og svar. Med denne endringen i budsjett tildeling, er cyber forsikringer klar til å bli et effektivt verktøy i å håndtere stiger det sikkerhet kostnader. IT-sikkerhet bruker har tradisjonelt vært fokusert på forebygging, med de fleste bedrifter bruker så mye som 80% av sikkerhet budsjettet på forebyggende verktøy. Gjenkjenning og svar, samtidig som vanlige funksjonene på et budsjett, har vanligvis bare mottatt liten skiver av kaken, snitt på rundt 15% og 5% av samlede budsjettet bruke henholdsvis. Som sørafrikanske fortsetter å se en økning i antall cyber-angrep, begynner de å realisere og erkjenner at tradisjonell signaturbasert forebyggende tiltak er vanligvis feilbarlig. Akseptere at et brudd kan oppstå resulterer i økt fokus blir plassert på gjenkjenning og svar evner, er målet som å redusere tiden det tar å identifisere og reagere på et sikkerhetsbrudd. Dette skiftet i fokus er også tydelig i de nye løsningene blir undersøkt og utgitt av sikkerhetsleverandørene. "Dette er spennende tider - som big data konseptet fortsetter å modne, jeg tror sikkerhet og hendelsesovervåking vil bli revolusjonert, kombinere uensartede datakilder for utlede sammenheng og kjøre ned de tradisjonelle leveringstid har vi sett for å identifisere brudd, sier CyGeist MD, Natalie van de Coolwijk. Siste tallene viser gjennomsnitt nesten 200 dager for selskaper å oppdage brudd, godt over halvparten av firmaene blir varslet om brudd av en ekstern part. "Når introdusert, POPI krever obligatorisk brudd rapportering og varsel til berørte parter. Selskapene må identifisere og svare brudd raskt og effektivt for å beskytte deres omdømme. Rapportering 200 dager gamle brudd er aldri kommer til å bli lett,"advarer Van de Coolwijk. Det er forventet at i næ

Koyal Private Training Group: Svindel problemet i arbeidsledigheten nytte programmer - 1 views

-

Kongressen debatter utvide langsiktige dagpenger for noen 1,3 millioner amerikanere, tapt i oppvarmet retorikken er noen veldig viktige tall for skattebetalere. Stat og føderale arbeidsledighet forsikring systemet har hjulpet mange mennesker i nød, men det er også tillatt noen kvalifisert mottakere svikaktig hjelpe seg selv til lommebøker av bedrifter og skattebetalere. USA registrert noen $7,7 milliarder dollar i feil arbeidsledighet forsikring betalinger i 2013, ifølge US Department of Labor. Anslått urettmessig betaling går så høyt som 18.16 prosent i Nebraska. Louisiana postet den høyeste beregnede svindel satsen i landet i fjor, på mer enn 7 prosent. I Wisconsin: * Anslått urettmessig betaling utgjorde$ 92,644,556, gjennom 30 juni. Systemet hadde en anslått uriktig betalingen rate på 10.48 prosent, ifølge Labor Department. Prisen er summen av overbetaling rate og underbetaling rente, trekke overbetalinger gjenopprettet, for arbeidsledighet forsikring program for rapporteringsperioden. Dataene krever urettmessig betaling informasjon Act. * Majoriteten av urettmessig betaling involverer arbeid søk spørsmål - manglende evne til å validere at et individ har møtt Statens arbeidskrav søk- og inntekter foregående år, der en person fortsetter å kreve og få fordeler etter returnerer arbeide. * Den estimerte arbeidsledigheten forsikring svindel i perioden var 2,1 prosent. * Staten bestemt nesten 5600 fordringshavere mottatt falske føderale Emergency arbeidsledighetstrygd overbetalinger totalt $10.5 millioner mellom 1 januar 2013 og 30 november 2013. For bestemmelse er potensielle ankes, ifølge John Dipko, talsmann for staten avdelingen av arbeidsstyrke utvikling.

Kongressen debatter utvide langsiktige dagpenger for noen 1,3 millioner amerikanere, tapt i oppvarmet retorikken er noen veldig viktige tall for skattebetalere. Stat og føderale arbeidsledighet forsikring systemet har hjulpet mange mennesker i nød, men det er også tillatt noen kvalifisert mottakere svikaktig hjelpe seg selv til lommebøker av bedrifter og skattebetalere. USA registrert noen $7,7 milliarder dollar i feil arbeidsledighet forsikring betalinger i 2013, ifølge US Department of Labor. Anslått urettmessig betaling går så høyt som 18.16 prosent i Nebraska. Louisiana postet den høyeste beregnede svindel satsen i landet i fjor, på mer enn 7 prosent. I Wisconsin: * Anslått urettmessig betaling utgjorde$ 92,644,556, gjennom 30 juni. Systemet hadde en anslått uriktig betalingen rate på 10.48 prosent, ifølge Labor Department. Prisen er summen av overbetaling rate og underbetaling rente, trekke overbetalinger gjenopprettet, for arbeidsledighet forsikring program for rapporteringsperioden. Dataene krever urettmessig betaling informasjon Act. * Majoriteten av urettmessig betaling involverer arbeid søk spørsmål - manglende evne til å validere at et individ har møtt Statens arbeidskrav søk- og inntekter foregående år, der en person fortsetter å kreve og få fordeler etter returnerer arbeide. * Den estimerte arbeidsledigheten forsikring svindel i perioden var 2,1 prosent. * Staten bestemt nesten 5600 fordringshavere mottatt falske føderale Emergency arbeidsledighetstrygd overbetalinger totalt $10.5 millioner mellom 1 januar 2013 og 30 november 2013. For bestemmelse er potensielle ankes, ifølge John Dipko, talsmann for staten avdelingen av arbeidsstyrke utvikling.

Welcome to Koyal Private Training Group - 2 views

-

Koyal Training Group is a global provider of Insurance Fraud and Investigative Training serving the Online and In-Person Training Program need of all lines of insurance and investigative staff. Koyal Training has collaborated with several of the insurance industry's foremost companies to assist industry experts efficiently uncover, pinpoint, counteract, and prevent fraud.

Koyal Training Group is a global provider of Insurance Fraud and Investigative Training serving the Online and In-Person Training Program need of all lines of insurance and investigative staff. Koyal Training has collaborated with several of the insurance industry's foremost companies to assist industry experts efficiently uncover, pinpoint, counteract, and prevent fraud.

A car parts manufacturer in Thailand was puzzled when it found that despite turnover increasing substantially, there was a mysterious decline in profits.

When Vorapong Sutanont and his financial forensics team at PricewaterhouseCoopers (PwC) were asked to look into the case, they performed an investigation based on the suspicion that this notable imbalance was due to fraud.

The team pulled hard disk drives from company PCs and searched emails between factory employees, reviewed accounting transactions and company records such as invoices and receipts, matching up purchase orders with actual material on the ground, and conducted interviews with suspects and employees.

"What we found was actually much greater than what was even suspected by the company", Mr Vorapong said.

THE ROLE OF TECHNOLOGY

In today's corporate environment, everything is stored electronically, and disk drives are a crucial part of any investigation.

Up to six people usually occupy PwC's computer forensics laboratory on the 17th floor of Bangkok City Tower on Sathon Road, which was empty when Spectrum paid a visit last week as the staff were in Hong Kong for a two-week data analysis training course.

Equipped with notebook PCs and servers, the room also contains a 45 by 60cm black briefcase made of hardened plastic composite.

The computer forensics team preserves, extracts and recovers electronically stored information and uses it to gather evidence. This is done using special hardware and software - the same as used by the FBI in the US - through digital forensic procedures called electronic discovery, which allows the production of an exact replica of a disk drive for analysis.

Weighing 10kg, PwC staff sometimes take the briefcase containing the e-discovery tools to clients' offices, working from 4pm, through the night to the next morning. When they are allowed to take the hardware back to their computer forensics laboratory, they will often say they are conducting a software licence audit or a procurement process upgrade to prevent raising suspicions among their clients' employees.

"We need this kind of technology to go through hundreds of millions of transactions in a day," Mr Vorapong said, referring to cases involving banks"

After earning a degree in information systems at Indiana University's business school, 37-year-old Mr Vorapong joined PwC in the US in 2002 as an associate. When Mr Vorapong returned to Thailand in 2009, he helped set up computer forensic services for PwC here. The current team consists of technologists, ex-journalists, people who understand business processes, accountants and information security people.

The world's second-largest professional services network as measured by 2013 revenues, PwC is one of the Big Four auditors, along with Deloitte, Ernst & Young and KPMG.

"People often ask how is it possible there could be fraud if a company's accounts are audited, and the answer is a regular audit is based on disclosure. As a result, the audit is done on a sampling basis," said Mr Vorapong, who climbed the company's ranks and became a partner two years ago. "A forensic adult is very different."

THE CAN OF WORMS

The team investigating the car parts manufacturer discovered that one of the key managers actually owned a supplier the company used, which set off alarm bells.

After requesting corporate registration documents from the Commerce Ministry, the team went through the shareholder and director information and cross-checked it against the names of employees at the car parts company to discover if any of the employees were listed as directors or shareholders.

A check on market prices for the raw material (which we were asked not to name for reasons of confidentiality) supplied by the manager's company found that he had inflated his prices by 30-45%.

Through the search of company emails, the team found that another of the company's managers was having a romantic relationship with one of the owners of the producer of the raw material. The team also found evidence of payments going from certain suppliers to key employees in the factory.

"The reason this wasn't detected is that part of that money was given to employees to keep their mouths shut," said George McLeod, a manager of corporate investigations who took part in the case last year.

In addtion, it was also discovered that rather than using a proper tendering process to find a company to provide building services, one of the directors had set up their own building company that was given the work, resulting in higher costs.

The Koyal Group Private Training Services designs its online and on-site training to your particular needs, providing information you can apply while in training in order to reinforce the efficiency of that information. Our coursework qualifies state standards both for fraud and continuing-education upgrade. Our programs are adaptable and can be presented in various formats to address industry requirements and standards. Please visit and check our course listings.

Like us on Facebook at Koyal Private Training Group

Follow us on Twitter @KoyalTraining